Featured

- Get link

- Other Apps

Anti-money Laundering High Risk Jurisdictions

The idea of cash laundering is very important to be understood for those working in the financial sector. It is a course of by which soiled cash is converted into clean cash. The sources of the cash in precise are criminal and the cash is invested in a approach that makes it appear to be clear cash and hide the id of the prison a part of the money earned.

While executing the monetary transactions and establishing relationship with the brand new clients or sustaining current customers the duty of adopting satisfactory measures lie on every one who is a part of the organization. The identification of such ingredient in the beginning is straightforward to take care of as a substitute realizing and encountering such conditions in a while in the transaction stage. The central financial institution in any nation gives complete guides to AML and CFT to combat such activities. These polices when adopted and exercised by banks religiously provide sufficient security to the banks to deter such conditions.

The high risk countries are. Reporting entities are generally required to apply enhanced due diligence when dealing with funds from jurisdictions that are high risk.

Eu Policy On High Risk Third Countries European Commission

Moreover the Commission has published the list of high risk jurisdictions even as its Action Plan for a Comprehensive Union policy on Preventing Money Laundering and Terrorist Financing is still being subject to stakeholder consultation that will conclude by July 2020.

Anti-money laundering high risk jurisdictions. The FATFs process to publicly list countries with weak AMLCFT regimes has proved effective click here for more. High-risk jurisdictions have significant strategic deficiencies in their regimes to counter money laundering terrorist financing and financing of proliferation. The FATF encourages all countries and jurisdictions to conduct improved due diligence on all listed countries as high-risk.

Until the end of the Brexit transition period the list of high-risk countries was determined by the European Union EU under the 4th Anti Money Laundering Directive. And 2 Jurisdictions with strategic AMLCFT insufficiencies that have not yet made the adequate. FATF issues public statements identifying high-risk and non-cooperative jurisdictions ie jurisdictions with strategic deficiencies in anti-money launderingcountering the financing of terrorism measures.

Requirement to apply Enhanced Due Diligence for higher risk jurisdictions. Money Laundering and Terrorist Financing controls in higher risk jurisdictions. Requirement to apply Enhanced Due Diligence for higher risk jurisdictions Minister of Legal Affairs Hon.

HM Treasury Advisory Notice. Under Schedule 8 of the EU Withdrawal Act any changes to the EUs list will cease to have effect in the UK once the Transition Period has ended. High-risk and other monitored jurisdictions.

While the EU list of uncooperative tax jurisdictions is a Council-led process the EU list of high-risk third countries is established by the Commission based on EU anti-money laundering rules. Jurisdictions with Anti-Money Laundering and Combating the Financing of Terrorism Deficiencies On June 30 2020 the Financial Action Task Force FATF reissued its list of jurisdictions with strategic deficiencies in their regimes to counter money laundering terrorist financing and proliferation financing with updates to two jurisdictions. For all countries identified as high-risk the FATF calls on all members and urges all jurisdictions to apply enhanced due diligence and in the most serious cases countries are called upon to apply counter-measures to protect the international financial system from the ongoing money laundering terrorist financing and proliferation financing risks emanating from the country.

This is done three times a year. High-risk and non-cooperative jurisdictions according to FATF Australia is a member of the Financial Action Task Force FATF an inter-governmental body that sets AMLCTF standards monitors the progress of members and identifies vulnerabilities that could expose the international financial system to misuse. The FATF identifies jurisdictions with weak measures to combat money laundering and terrorist financing AMLCFT in two FATF public documents that are issued three times a year.

Money laundering and funding of terrorism risk which originate from the respective jurisdictions High Risk Jurisdictions subject to a call for action. Kathy Lynn Simmons JP today issued AML-ATF Advisory 22018 about the risks in a number of jurisdictions arising from inadequate systems and controls to. High-Risk Jurisdictions under Increased Monitoring High-risk jurisdictions anti-money laundering anti-terrorism funding and anti-proliferation financing regimes have significant strategic deficiencies.

The two lists complement each other in ensuring a double protection for the Single Market from external risks. Anti-money laundering and countering the financing of terrorism EU policy on high-risk third countries Based on Directive EU 2015849 Article 9 the Commission is mandated to identify high-risk third countries having strategic deficiencies in their regime on anti-money laundering and countering the financing of terrorism. Under the UKs Money Laundering Regulations regulation 331b enhanced due diligence EDD is mandated for any business relationship with a person established in a high-risk third country.

High-Risk Jurisdictions under Increased Monitoring High-risk jurisdictions anti-money laundering anti-terrorism funding and anti-proliferation financing regimes have significant strategic deficiencies. The FATF encourages all countries and jurisdictions to conduct improved due diligence on all listed countries as high-risk. Regulation 333a defines a high risk third country as a country listed by the EU by Delegated Act pursuant to the EUs powers under the 4th Anti Money Laundering Directive.

For all countries identified as high-risk the FATF calls on all members and urges all jurisdictions to apply enhanced due diligence and in the most serious cases. The Money Laundering and Terrorist Financing Amendment Regulations 2019 MLRs 2019 require the UK regulated sector to. The Financial Action Task Force FATF also known as the Global Anti-Money Laundering watchdog updates its list of high-risk and other monitored jurisdictions which are considered to have weak AML-CFT regimes.

The Financial Action Task Force FATF has released its list of high risk jurisdictions for money laundering and counter terrorist financing.

International Banking Wealth Management Aml Quality Control Effective Anti Money Laundering Prezentaciya Onlajn

Anti Money Laundering And Counter Terrorism Financing

Layering Aml Anti Money Laundering

Anti Money Laundering What It Is And Why It Matters Sas

Revised Central Bank Amla Guidelines Anti Money Laundering

A Guide To Anti Money Laundering Aml Compliance Veriff

Pdf Anti Money Laundering Regulations And Its Effectiveness

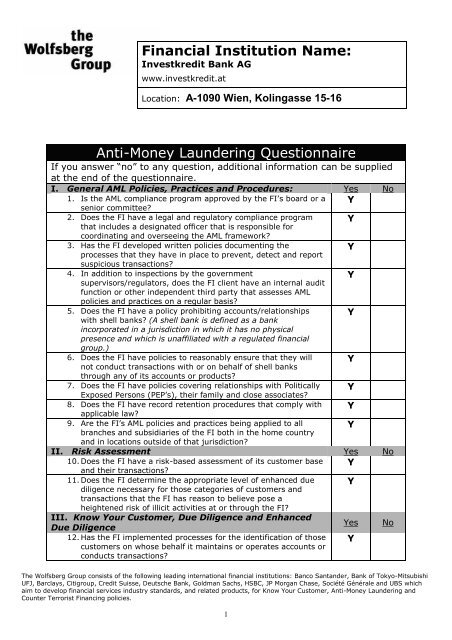

Anti Money Laundering Questionnaire Volksbank

Layering Aml Anti Money Laundering

International Banking Wealth Management Aml Quality Control Effective Anti Money Laundering Prezentaciya Onlajn

Anti Money Laundering And Counter Terrorism Financing

Anti Money Laundering And Counter Terrorism Financing

Anti Money Laundering And Counter Terrorism Financing

Infographic Of Anti Money Laundering Aml Analysis Raconteur Net Money Laundering Finance Infographic Infographic

The world of rules can seem to be a bowl of alphabet soup at occasions. US money laundering regulations are not any exception. We have compiled an inventory of the highest ten cash laundering acronyms and their definitions. TMP Threat is consulting firm focused on defending monetary services by lowering danger, fraud and losses. Now we have massive bank expertise in operational and regulatory threat. We have now a strong background in program administration, regulatory and operational threat in addition to Lean Six Sigma and Business Course of Outsourcing.

Thus money laundering brings many hostile consequences to the organization because of the risks it presents. It increases the likelihood of major risks and the opportunity cost of the bank and ultimately causes the bank to face losses.

Popular Posts

The Little Mermaid Screencaps Gallery

- Get link

- Other Apps

Comments

Post a Comment